We received substantial feedback on the exchange rate for the BAT sale. We appreciate the questions we received and thought some background would help explain our approach. We strive for transparency and hope to clear up misunderstandings.

As everyone knows, USD/ETH prices have grown more volatile. When we first contemplated this project, the USD/ETH prices were relatively stable. For quite sometime, they hovered at around $10/ETH. We assumed people would be pleased with the simplicity of a fixed exchange rate. As ETH grew more volatile, we knew this would become challenging. However, we didn’t receive any strong feedback on the fixed exchange rate in our published contracts.

As such, we maintained the same approach as the sale date neared. We gauged the volatility as we attempted to find a price that remained in line with the goals we had outlined. In the days before the exchange rate decision was made, the average trade price looked close to $153.

The exchange rate decision was made May 28 in the late evening. We considered the last 3 days of prices to try to reach the target price on the token sale day (approximately 2.5 day

Various members of the team looked at prices over the decision period, and I looked at the poloniex charts, which are fortunately still available here: https://poloniex.com/

Tether isn’t the best USD proxy, so we’ll scale it up by the 2% premium it trades at.

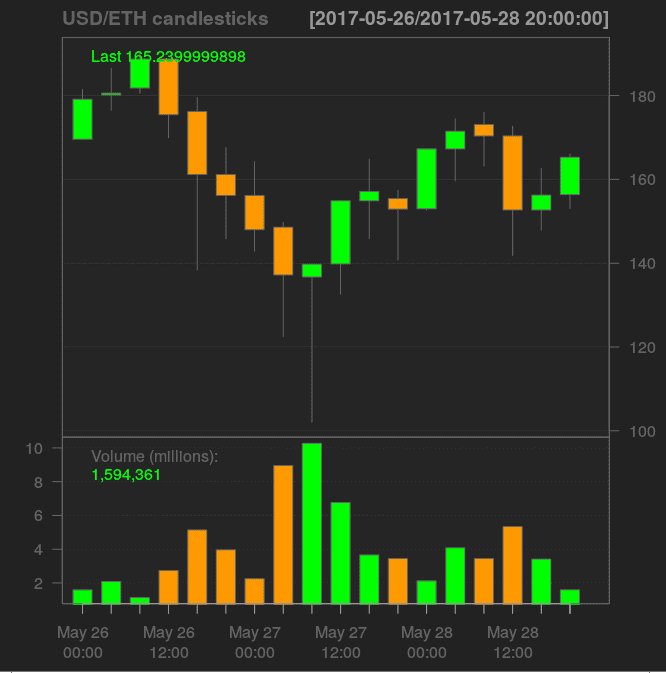

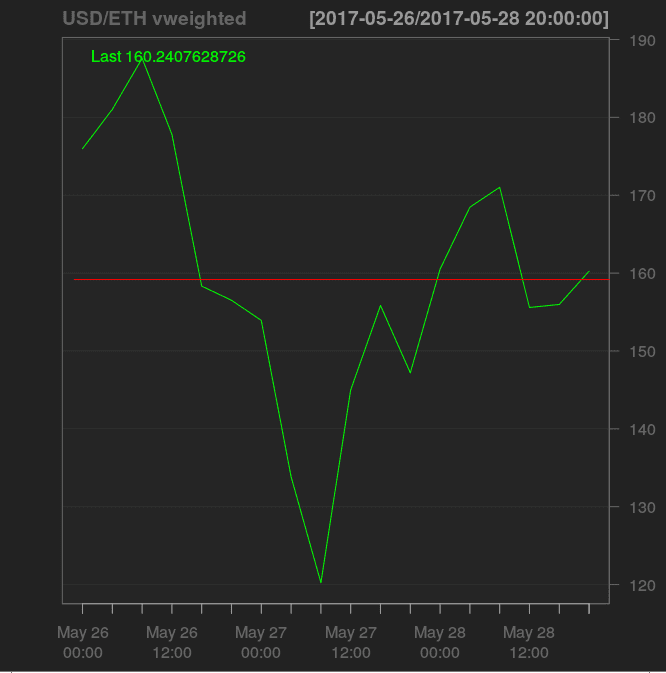

This is the chart we were looking at:

If you look at the volume weighted field in that time range, it certainly looked pretty close to $153.6. The actual mean value (scaled up by the 2% tether premium) was $159.2.

This was our best guess at the moment we made the pricing decision on pricing.

We would have liked to get this exactly right, but I suppose if we could predict crypto-currency prices at 3 days out, we’d be in a different line of business.

It is also important to remember that we may not be able to access our token sale proceeds until approximately June 29. The mean value of ETH is $109 during the 30 days prior to our decision. One could argue that the price may be going up for various reasons, but these are post-facto arguments.

The best interests of the company and the token holders remain aligned. A strong base allows the BAT to establish itself across the web as a new standard in a transparent and efficient blockchain-based digital advertising platform. The opportunity for all involved, e.g., users, publishers, advertisers, etc., is substantial.

In the end, we made some hard decisions. Do we wait for the volatility to reduce? Is there a more optimal exchange mechanism beyond a rate fixed at deploy time? There is good debate to be had on these issues. But, ultimately, people have to make their own decisions as to where to allocate their ETH and whether to purchase BAT. In the end, the market decides.

Scott Locklin

May 30, 2017